A Guide to Managing Your Innovation Portfolio

According to Capgemini, since 2000, 52% of companies in the Fortune 500 have either gone bankrupt, been acquired, or ceased to exist.

Disruption is real and markets are more dynamic than ever. Can you keep up? And do you know what it takes to lead the pack?

This blog post will deep dive into the importance of a dual innovation portfolio approach. It will show you how to set up and manage an innovation portfolio effectively.

The Importance of a Dual Innovation Portfolio Approach

A company-wide innovation portfolio should monitor and steer all innovation projects, from ideas to implemented initiatives and beyond. This demands a dual portfolio strategy.

A dual portfolio strategy consists of:

A) EXPLORE: monitor and steer new innovation projects, from idea to validation and proof-of-concept. (Focus: de-risk and select)

B) EXPLOIT: monitor and steer implemented projects post-launch. (Focus: optimize and scale)

While the EXPLORE portfolio focuses on new, potentially disruptive ideas, the EXPLOIT portfolio consists of initiatives and projects that have been launched and implemented. Both portfolios demand your attention to not exclusively come up with the next big thing (EXPLORE) but also double down on what works (EXPLOIT). The challenging part is that the characteristics of the two portfolios couldn’t be more different…

Note: The concept of an EXPLORE and EXPLOIT portfolio was first introduced by Alex Osterwalder and co. in their book “The Invincible Company”.

Explore: From Idea to Launch

A healthy exploration portfolio shows some distinctive characteristics which we, in detail, described in a former blog post “A guide to executing Innovation Strategy”.

We’ve described the importance of a stage-gate-innovation process, that welcomes a wide array of raw ideas, followed by a rigorous validation of these ideas.

The EXPLORE stage-gate process resembles a Venture Capital funnel, consisting of ideas that deal with high uncertainty. The focus is on de-risking these ideas in terms of their desirability, viability, feasibility, and strategic fit to the company.

Based on the stage the idea is in (raw idea to validated idea vs. validated idea to proof-of-concept vs. proof-of-concept to implementation), the budget and resource allocation significantly differ. The comparison with a VC funnel is eminent - think of funding rounds such as pre-seed, seed, series A, series B, etc.

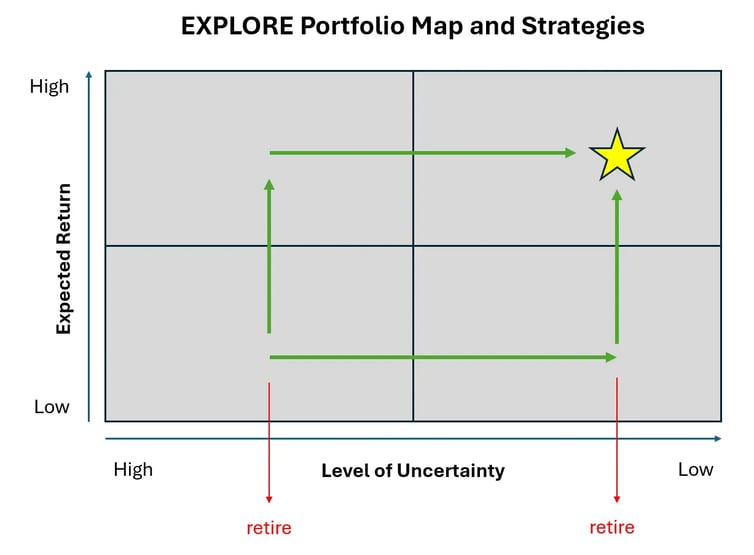

Below is a visual illustration of an EXPLORE portfolio indicating portfolio strategies to move ideas with high uncertainties to low uncertainties and with low expected returns to high expected returns (or to retire the ideas if such a development is not possible).

Retiring ideas is a strategy that is paramount in this early stage of innovation. If you want to learn more about the recommended average stage-by-stage ratios (how many ideas are stopped vs. move on) within the EXPLORE portfolio, read this blog post.

Exploit: From Launch to Optimization

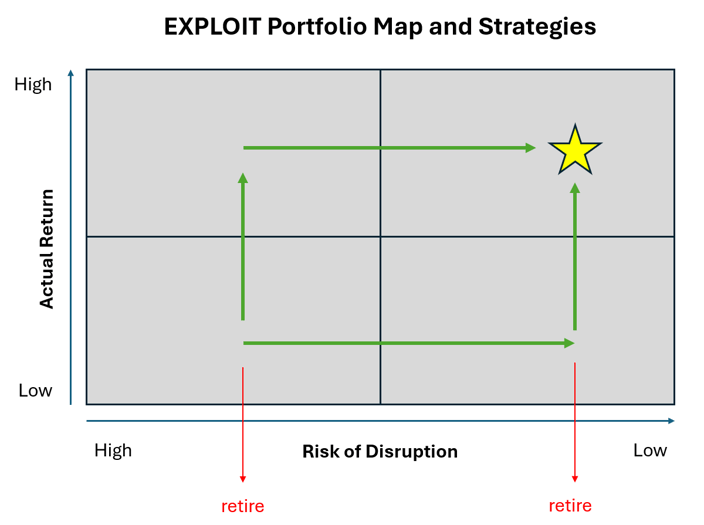

While the EXPLORE portfolio focuses on raw ideas with high uncertainties, the EXPLOIT portfolio deals with launched projects, that show (initial) returns. Therefore, the focus is no longer on expected outcomes and returns but on developing the actual returns of the projects. Meanwhile, it is key to defend the innovations from disruptions and emerging products and market incumbents.

Accordingly, an EXPLOIT portfolio matrix can look as follows - much inspired by the great work of Osterwalder and co. in their book “The Invincible Company”:

Aligning Portfolio and Strategy

While the mentioned dimension of “Strategic Fit” in the early stage validation of ideas should be a guiding indicator for the prioritization of EXPLORE-type ideas, it remains an important factor to track and analyze for steering the resource allocation in the EXPLOIT portfolio - you want to allocate resources to projects that truly matter for the future of your business.

Besides retroactively tracking the “Strategic Fit” of initiatives across your innovation funnel, you can proactively source ideas that fit your strategy. We often support our clients in launching campaigns, that communicate strategic search topics to employees, to source and attract matching ideas - a topic that in itself is worth a blog post.

A Word on Decentralization

While innovation portfolio management is often seen as a central discipline, it is important to stress, that today's modern software tools such as rready’s innovation platform support companies to decentralize innovation management. Think of decentralized idea sourcing, scoring, and executing. Think of matching experts to projects based on pre-configured topic areas and of enabling employees to submit and co-create in their home language. From the perspective of an innovation portfolio manager, think of transparency across the platform and funnel on project KPI’s, resource allocations, and strategic decisions at each gate of your funnel.

Effectively managing your innovation portfolio is critical for driving business growth in an increasingly competitive landscape. By understanding the composition of your portfolio, assessing opportunities, prioritizing innovations, allocating resources strategically, and continuously monitoring and adjusting your approach, you can cultivate a culture of innovation that propels your organization toward success.

Continuously investing in corporate innovation and embracing a dual innovation portfolio strategy can help you lead the pack and become an innovation leader in your industry.

For further insights into innovation accounting and metrics, check out these resources:

Remember, innovation is not just about generating new ideas; it's about executing them effectively to create value for your customers and stakeholders. rready has helped many companies to embrace innovation as a core driver of growth, and unlock new opportunities. Contact us to arrange a full demo.

Get started today